how are rsus taxed at ipo

Deciding what to do with restricted stock units may even become more complicated if you. RSUs look straightforward because your options can seem limited meaning you have fewer decisions to make.

Restricted Stock Units Jane Financial

It not only determines your tax bracket but also tells you Calculation.

. But the truth is you may have several choices around the actions to take next including how to pay the requisite tax due or if you should retain shares after vesting. Generally such elections are handled. Keep Or Sell Rsu Reddit.

RSUs are the industry standard for broad-based grants in firms past the startup stage. When your first 250 shares vest suppose the price has gone up to 20 per share great you will have W-2 income of 250 20. Refer to Section 5303.

Non-qualified stock options. 250 shares would vest each year over 4 years. If you have received restricted stock units RSUs congratulationsthis is a potentially valuable equity award that typically carries less risk than a stock option due to the lack of leverage.

This calculator only predicts an estimate of rewards. An election pursuant to IRC 83b allows a recipient of restricted property to be taxed when the property is transferred instead of when the property actually vests at a later date when the value may be higher. In the case of a Non-Resident LTCG on Unlisted Stock is 10 without Indexation.

Prior to an IPO the company may have a. Tax rates and tab le. Unlike stock options which can go underwater and lose all practical value.

For overseas employees RSUs prevent hassles in countries where restricted stock is taxed at grant and the taxation may not be delayed until vesting. RSUs are taxed as ordinary income as of the date they become fully vested using the FMV of the shares on the date of vesting. Regardless of market fluctuations an RSU always has value.

Often less than 1. This is a good method to keep the employees connected with the companys growth. Trader should file ITR 2 ITR for Capital Gains Income on Income Tax Website since income on the sale of unlisted stocks is a Capital Gains.

The RSUs are taxed as income when they vest. A research by Forbes shows that professionals with an AWS Certified Solutions Architect Certification have a potential annual salary of 125971. Like RSUs restricted stock awards are a way for the company to reward employees with stock in addition to their.

RSUs as an equity vehicle offer greater stability and protection against volatility than stock options. Your taxable income is the market value of the shares at vesting. An initial public offering or IPO is a process in which a private company offers its shares of stock to public investors for the first time.

In this employees are granted the right to purchase stocks through payroll deductions at a 15 tax-free discount. Moreover the RSUs can be easily canceled if your performance-vesting goal is not met. This is a popular equity awards plan among startups with a recent IPO.

ITR Form Due Date and Tax Audit Applicability for Unlisted Shares. STCG taxed as per slab rates. Working for a company before it goes public can be highly beneficial for employees who have stock options or RSUs after a successful IPO.

Use SmartAssets capital gains tax calculator to figure out what you Use the RSU Tax Calculator to estimate the impact of taxes when your. If you still work for the company or if youve left and exercised your. With RSUs you are taxed when you receive the shares.

So if you vested 10000 shares at 10 each thats 100000 of value you received which means that money will be taxed like ordinary income just like your salary and your bonuses. Stock options become less effective as a company gets larger and the transition to RSUs is a normal step in the growth. RSAs are like RSUs in many ways but have their own unique differences as well.

However since your vested RSUs are granted to you and you dont have to pay for them theyre considered income when they vest rather than an investment expense. Suppose you got 1000 RSUs a year ago and the stock price was 10 per share at that time. The price at the time when they were granted doesnt matter.

Taxed as per capital gains rate and not the regular high-income tax rate. The election must be made no later than 30 days from the date the property is transferred to the service provider with no extensions. RSUs can be easier to use when vesting is performance-based as no shares need to be issued up front with RSUs.

Are RSUs Taxed TwiceNet Price Calculator. When employees are given stock options at an early-stage startup they usually have the right to buy shares at a very low valuation.

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc

Avoiding The 1 Million Tax Trap New Section 162 M Regulations Affect Use Of Rsus By Ipo Companies Compensia

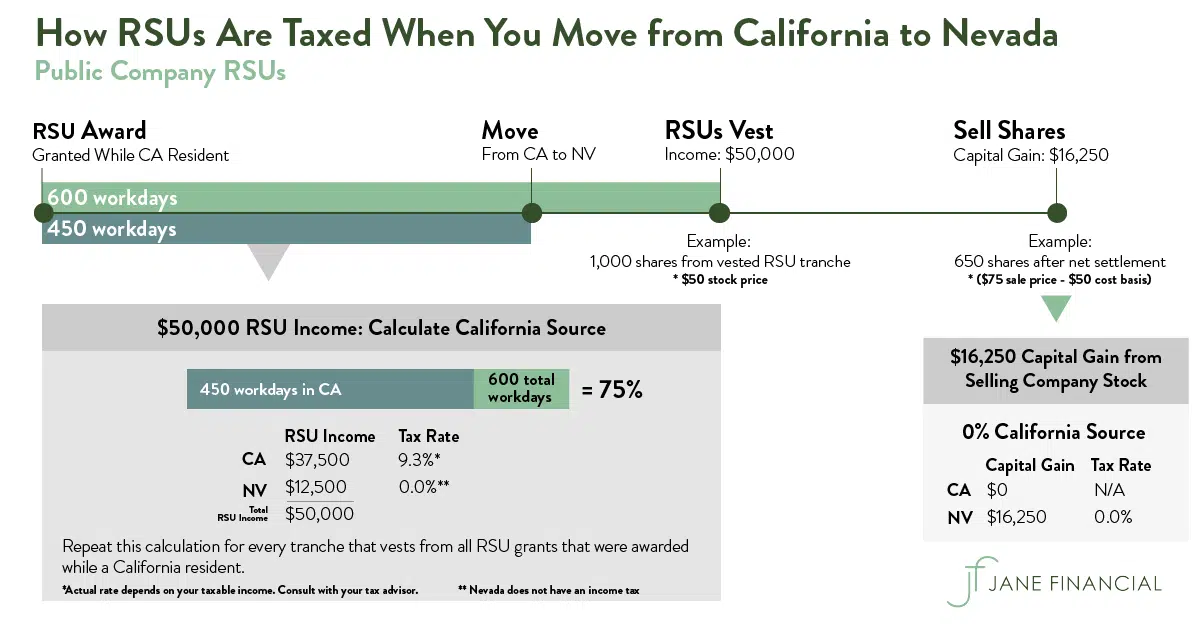

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc